Home › Accelerate Fintech with a Trusted Data Solution for Compliance

Accelerate Fintech with a Trusted Data Solution for Compliance

In the fast-paced world of fintech, speed is everything. We’ve moved from yearly to hourly deployments, but a major roadblock remains: regulatory compliance. While CI/CD pipelines promise frictionless development, the need for secure, compliant test data often grinds innovation to a halt. This blog explores how on-demand synthetic data can break this stalemate, allowing you to have both speed and security.

The Fintech Race: Speed vs. Security

We’ve been in the technology sector for many years now, and if there’s one constant, it’s the relentless pursuit of speed. This acceleration, a core component of the broader digital transformation, is most pronounced in the Fintech industry. We’ve gone from releasing yearly to monthly, and now to deploying daily or even hourly. In the world of digital banking and financial services, being first to market isn’t just an advantage; it’s often the difference between relevance and obsolescence. Fintech companies live and breathe by Agile and CI/CD principles. The goal is a frictionless pipeline: code, commit, test, deploy. Repeat.

The Hidden Brake on Innovation: The Data Bottleneck

In an ideal CI/CD system, every time a developer submits code, automated compliance checks run. These checks use a realistic, production-like environment. But in the real world of financial services, that environment requires data, and using raw production data is a cardinal sin, especially when facing strict standards like PCI DSS. This is where the pipeline breaks down for so many financial institutions.

The traditional solution is a manual, ticket-based process that hinders the entire organization. A developer needs data to test a new feature that must meet specific compliance requirements. They file a request. That request goes to a separate team, who then begins the painstaking process of manual Data transformation. This process is fraught with problems. The process is very slow. Developers cannot properly test important AML procedures. They also cannot check if fraud controls are correctly implemented. As a result, developers and QA teams end up spending about 25% of their time just dealing with defective test data. This isn’t just a bottleneck; it’s a systemic drag that injects risk, cost, and delays at every stage, making future Compliance Audits a terrifying prospect.

Breaking the Stalemate: Synthesize Data in Your Pipeline

It’s time to move beyond the limitations of traditional development workflows. What if we could completely eliminate the bottleneck created by provisioning test data? Imagine a new reality for developers, where the process of acquiring test data—often a manual, time-consuming, and compliance-heavy task—is no longer a barrier.

Picture this: developers can provision test data that is safe, realistic, and fully compliant on-demand. This isn’t a separate, cumbersome process; it’s an integrated and automated part of the CI/CD pipeline, available precisely when and where it’s needed.

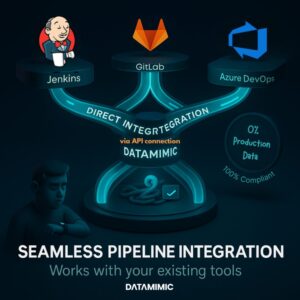

This vision isn’t a futuristic concept or a theoretical ideal. It is the tangible solution we have built and refined at DATAMIMIC (a modern synthetic data generation tool). Our platform stands as a clear and compelling example of how modern compliance technology can directly solve one of the most persistent and costly challenges in software development.

Through secure API integration, DATAMIMIC connects directly into your workflow. Using a powerful Machine Learning engine, it learns from your production schema—without ever accessing sensitive data itself. From this model, it can create synthetic data on the fly. This fundamentally strengthens your API security posture by design. This data is completely synthetic. It has no real production information. It is safe and meets all regulatory requirements, including PCI DSS. There’s no risk of data leakage. This on-demand approach, which can be delivered as part of our managed services, turns data into just another automated step, streamlining your entire compliance flow. A major benefit here is enhanced API security, as you are not exposing production data or live APIs during the riskiest phases of development.

The Real Prize: Achieving the DevSecOps Dream

The ultimate objective extends beyond the mere acceleration of the development pipeline. Instead, it’s about cultivating a genuine DevSecOps culture, a framework where all teams share responsibility for security, rather than isolating it as a function. To achieve this, the integration of appropriate security tools is essential, enabling a “shift-left” approach that embeds compliance and security checks into the earliest phases of the software development lifecycle. Crucially, at the core of this transformation is a proactive approach to API security, which is fundamental to the entire mission. This forward-looking strategy ensures that potential vulnerabilities are identified and addressed long before they can become significant threats.

This is precisely where on-demand synthetic data comes in. When a developer can spin up a test environment with safe data, they can test for vulnerabilities, simulate incident response scenarios, and run real-time monitoring for issues. They can test for suspicious actions and validate their code against AML checks and Customer Due Diligence workflows from day one. As a result, established compliance frameworks are respected. This proactive testing of AML procedures and other rules fortifies the entire application.

Consequently, this changes the relationship between development and security from being against each other to working together. Ultimately, this helps get regulatory approval faster. This detailed and automated testing process also creates immaculate audit trails. This not only simplifies Compliance Audits but also improves your readiness for any incident response by the fact that we can robustly test features against established regulatory frameworks. Furthermore, continuous testing for critical standards like PCI DSS becomes an automated reality, not a manual burden.

In the high-stakes world of financial services, you cannot afford to choose between moving fast and staying compliant. The winners will be those who understand that security and a strong API security footing must be enablers of speed. These developers will understand the complex regulatory landscape, follow all FinTech regulations, and solve the data bottleneck to help their teams reach full potential.

This approach has a profound impact. As one of our users noted in a recent G2 review, DATAMIMIC helps their team “overcome slow development cycles caused by data dependencies and strict compliance regulations.” By removing the dependency on slow, manual processes, they reclaim the agility that was promised by CI/CD in the first place.

Interested in a faster, more secure CI/CD pipeline? You can streamline your development process and boost your team’s productivity without sacrificing regulatory compliance.

To see how our solutions can help you, book a free DATAMIMIC’s demo session at: https://info.rapiddweller.com/meetings/rapiddweller/datamimic-demo

Alexander Kell

August 7, 2025

Contact Us Now

Facing a challenge with your test data project? Let’s talk it through. Reach out to our team for personalized support.

You need to load content from hCaptcha to submit the form. Please note that doing so will share data with third-party providers.

More Information